ANALYSIS-Dollar’s rally may be nearing ‘tipping point’ as Fed readies big hikes

April 22 (Reuters) – A months-long rally in the dollar may be reaching its peak as the Federal Reserve gears up to deploy more interest rate hikes, according to the currency’s trading patterns in past tightening cycles.

The dollar has risen around 7% against a basket of currencies USD in the past year to its highest level since March 2020, boosted in part by expectations the Fed is ready to employ robust rate hikes to tame the worst inflation in nearly 40 years.

Those gains are largely consistent with the dollar’s behavior during the last four rate hike cycles, which has seen the U.S. currency climb an average of 2.2% in the 12 months before the central bank started raising interest rates.

In three out of the last four hiking cycles, however, the dollar index went on to pare some of its gains, losing an average of 1.4% between the first and last rate increase, according to a Reuters analysis of Refinitiv data.

“It is entirely possible that the dollar overshoots on the high side, revisiting levels we saw eight-nine years ago, but we think we are getting pretty close to a tipping point,” said Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management.

Analysts at Goldman Sachs wrote that the current projections of Fed tightening are comparable to the central bank’s rate path in 1994-1995, when policymakers raised rates by 300 basis points for the steepest hiking cycle in decades. The Fed raised rates by 25 basis points in March and investors are projecting nearly 260 basis points of cumulative rate increases through next February. FEDWATCH

While the dollar strengthened in the months prior to the first increase in 1994, it fell 8.4% by the time the Fed was through, as rate hikes by other global central banks closed the gap between U.S. yields and those in other currencies, Goldman’s analysts said in a recent report.

Although the gap between yields on U.S. debt and foreign government bonds has widened in recent weeks, that dynamic could change if other central banks grow more aggressive in monetary policy, or if U.S. data shows growth starting to slow.

“The moment the markets sniff properly that the Fed is done with their hawkishness amid the backdrop of slowing U.S. data, then the dollar will fall off and we can get back to looking at interest rate differentials,” said Richard Benson, co-chief investment officer at Millennium Global Investments.

European policymakers have recently ramped up hawkish rhetoric. Joachim Nagel, president of Germany’s Bundesbank, on Thursday said the European Central Bank could raise interest rates at the start of the third quarter.

An election win for French President Emmanuel Macron against far-right candidate Marine Le Pen on Sunday could also reduce headwinds for the euro, which is down 4.7% against the dollar this year. The Japanese yen, meanwhile, stands at a two-decade low against the dollar.

For now, however, momentum appears to be on the greenback’s side. The dollar index is up 2.3% for April, on pace for its best month since June 2021. The index is also on track for its fourth straight month of gains, the longest such streak in two years.

Sustained dollar strength could be a mixed bag for investors, corporations and governments. While a strong dollar may help the Fed tame inflation, it can exacerbate rising prices in economies whose currencies have weakened.

A strong dollar can also weigh on the profits of U.S. companies that derive revenues from abroad and need to convert them back into dollars. Procter & Gamble PG.N and Philip Morris International Inc PM.N are among companies that cited currency headwinds in this season’s earnings reports.

“We think we are getting very close to that point where companies are going to have to start admitting that the stronger dollar is hurting the translation of their earnings and hurting international competitiveness,” said Morgan Stanley’s Shalett.

The pressure on corporates could be temporary, though, if dollar bears are right.

Steve Englander, head of global G10 FX research and North America macro strategy at Standard Chartered Bank, believes the dollar could continue rising in coming months but will likely retreat during the course of the Fed’s rate hiking cycle, especially if other central bank’s grow more hawkish.

However, “that’s a story for the second half of the year, or even 2023,” he said.

GRAPHIC: Up, up and away for the dollar index https://tmsnrt.rs/3xL0IJ8

GRAPHIC: Fed hiking regimes and the U.S. dollarhttps://tmsnrt.rs/36ygWdd

GRAPHIC: U.S. dollar index in rate hiking regimeshttps://tmsnrt.rs/3L6U9UO

GRAPHIC: Advantage dollarhttps://tmsnrt.rs/3jVgAR9

(Reporting by Saqib Iqbal Ahmed and Gertrude Chavez-Dreyfuss; Writing by Ira Iosebashvili; Editing by Chris Reese).

by Saqib Iqbal Ahmed and Gertrude Chavez-Dreyfuss

source https://www.nasdaq.com/articles/analysis-dollars-rally-may-be-nearing-tipping-point-as-fed-readies-big-hikes

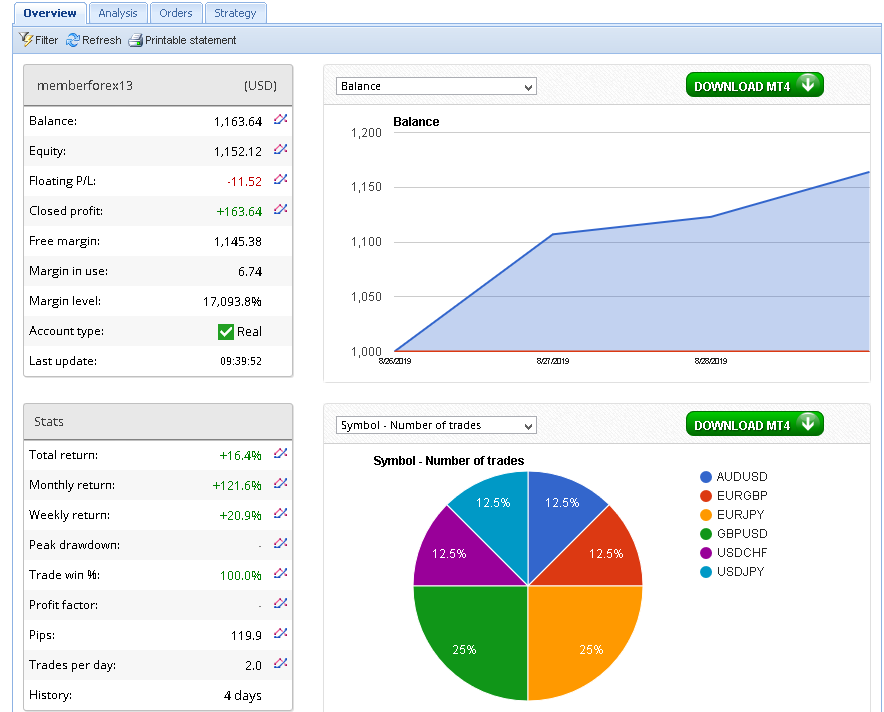

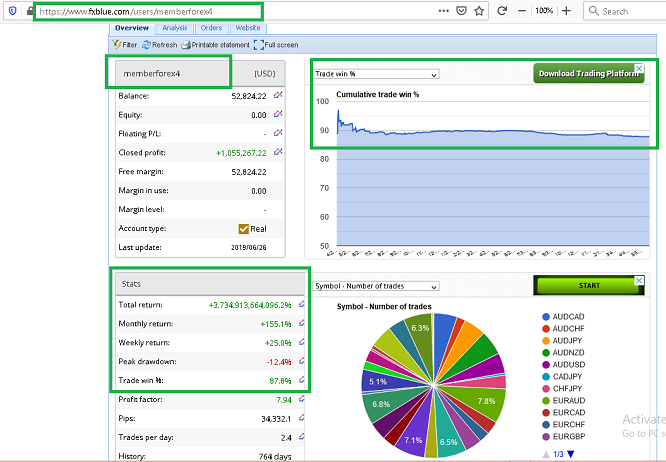

EA PAMM MAMM CopyTrader

EA PAMM MAMM CopyTrader

Hierarki Zone Dealer Unlimited

Pair Major, CFD, Commodity, Metal, Crypto

All TF. Recommended For Scalper & Swing Trader. Only For Real Account MT4

Pair Major, CFD, Commodity, Metal, Crypto

All TF. Recommended For Scalper & Swing Trader. Only For Real Account MT4