We see a big recession in the making : Top CEOs are fearing the worst in Europe

LONDON — The CEOs of several European blue chip companies have told CNBC that they see a significant recession coming down the pike in Europe.

The continent is particularly vulnerable to the fallout from the Russia-Ukraine war, associated economic sanctions and energy supply concerns, and economists have been downgrading growth forecasts for the euro zone in recent weeks.

The euro zone faces concurrent economic shocks from the war in Ukraine and a surge in food and energy prices exacerbated by the conflict, along with a supply shock arising from China’s zero-Covid policy. That has prompted concerns about “stagflation” — an environment of low economic growth and high inflation — and eventual recession.

“For sure, we see a big recession in the making, but that’s exactly what we see — it’s in the making. There is still an overhanging demand because of the Covid crisis we just are about to leave,” said Stefan Hartung, CEO of German engineering and technology giant Bosch.

“It’s still there and you see it heavily hitting us in China, but you see that in a lot of areas in the world, the demand of consumers has already even been increased in some areas.”

In particular, Hartung noted lingering consumer demand for household appliances, power tools and vehicles, but suggested this would dissipate.

“That means for a certain amount of time, this demand will still be there, even while we see the interest increase and we see the pricing increase, but at some point in time, it won’t be just a supply crisis, it will also be a demand crisis, and then for sure, we are in a deep recession,” he added.

Inflation in the euro zone hit a record high of 7.5% in March. So far, the European Central Bank has remained more dovish than its peers, such as the Bank of England and the U.S. Federal Reserve, both of which have begun hiking interest rates in a bid to rein in inflation.

However, the ECB now expects to conclude net asset purchases under its APP (asset purchase program) in the third quarter, after which it will have room to begin monetary tightening, depending on the economic outlook.

Berenberg Chief Economist Holger Schmieding said in a note Friday that near-term risks to economic growth are tilted to the downside in Europe.

“Worsening Chinese lockdowns and cautious consumer spending in reaction to high energy and food prices could easily cause a temporary contraction in Eurozone GDP in Q2,” Schmieding said.

“An immediate embargo on gas imports from Russia (highly unlikely) could turn that into a more serious recession. If the Fed gets it badly wrong and catapults the U.S. straight from boom to bust (unlikely but not fully impossible), such a recession could last well into next year.”

Yet Schmieding suggested that the euro zone is likely to enter recession only “if worse came to worst,” and that it isn’t a base expectation.

Mark Branson, president of German financial regulator BaFin, said any military escalation in Ukraine or further energy supply disruption could pose serious risks to growth in Europe’s largest economy, with industrial sectors particularly vulnerable.

“We’re already seeing that growth is down to around zero in many jurisdictions, including here, and it’s vulnerable. It’s also vulnerable from the ongoing Covid-related shocks,” he said.

“We’ve got inflation that’s going to need to be tackled, and it’s going to need to be tackled now, so that’s a cocktail which is difficult for the economy.”

‘Challenging business environment’

Slawomir Krupa, deputy CEO at Societe Generale, told CNBC on Thursday that the French lender is monitoring the macroeconomic picture closely.

“It’s obviously a fundamental piece of news for the macroeconomic context and the triggered inflation feedback loop between the energy shock – which was already going on before the war in Ukraine – you have the inflation expectation rising and the risk of a final, fundamental impact on the macroeconomy into a recession,” he said, adding that this would potentially affect “the entire system, and (SocGen) as well.”

Ola Kallenius, CEO of Mercedes-Benz, also told CNBC last week that the situation in China and the Ukraine war are making for a “challenging business environment” for the German luxury automaker in three distinct ways.

“On the one hand, we have the ongoing shortages mainly associated with semiconductors. On top of that, there are now new lockdowns in China, our biggest market, which will affect us in China but also can affect supply chains across the world, and in addition to that, of course, the Ukraine war, so the business environment is challenging,” he explained.

His comments were echoed by Volkswagen CEO Herbert Diess, who told CNBC on Thursday that the company also faced a “challenging environment” from Covid, the chip shortage and the war in Ukraine in the first quarter.

Maersk CEO Soren Skou said Thursday that the world’s largest shipping company is also keeping an eye on recession risks, particularly in the United States, but does not expect those to come to the fore until late 2022 or early 2023.

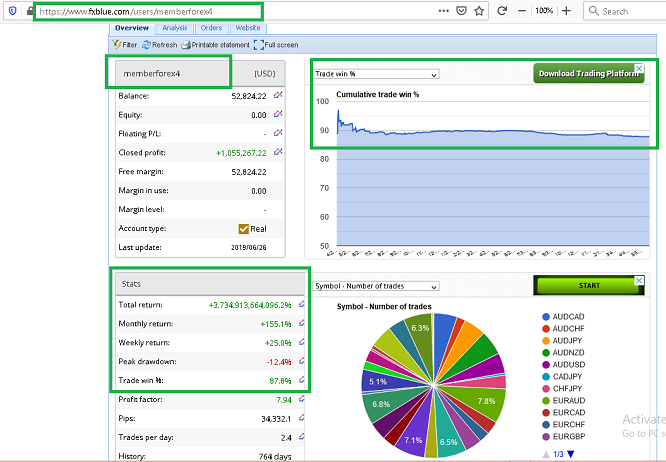

2 IN 1

2 IN 1

EA PAMM MAMM CopyTrader

EA PAMM MAMM CopyTrader

Hierarki Zone Dealer Unlimited

Pair Major, CFD, Commodity, Metal, Crypto

All TF. Recommended For Scalper & Swing Trader. Only For Real Account MT4

Pair Major, CFD, Commodity, Metal, Crypto

All TF. Recommended For Scalper & Swing Trader. Only For Real Account MT4